Donate up to $800. Receive it back in tax credits.

Special offer for members of Congregation NefeshSoul*

For every tax credit donation to the East Valley JCC Qualified Charitable Organization, Congregation NefeshSoul will receive an incentive grant equal to 18%.

$18 grant for $100 Tax Credit donation

$36 grant for $200 Tax Credit donation

$72 grant for $400 Tax Credit donation

$144 grant for $800 Tax Credit donation

Your donations help your community at no cost to you.

100% of the funds collected enrich the lives of people in your community.

To be eligible for the grant, donate below or write “Tax Credit Code Nefesh” on the memo line of your check.

Are you curious how it helps? Watch this short video:

Please help us meet our $150,000 goal!

Make your donation below

(Up to $400 for individuals/$800 for couples)

Donations can also be made via phone or mail.

Please call 480-897-0588 or mail a check with “Tax Credit Code Nefesh” on the memo line to:

East Valley JCC

908 N. Alma School Road

Chandler, AZ 85224

How the AZ Tax Credit works

Donate Now

You make a donation to the EVJCC, up to $400 individual or $800 couple.

Get Credit

You take a dollar-for-dollar TAX CREDIT on your AZ income tax return.

Win-Win

The EVJCC continues to help those in our community in need and you’ve helped make that happen!

Donations to the EVJCC stay here, in our community. The donations collected go toward programs for all age groups, to enrich the lives of people right here in our neighborhoods.

Help us reach our Tax Credit Goal of $150,000 by April 18, 2023. Let’s make this a reality!

Unlike other donations, this is not a deduction off your income. If you donate $800 you get $800 directly off your AZ State Income Tax Bill!

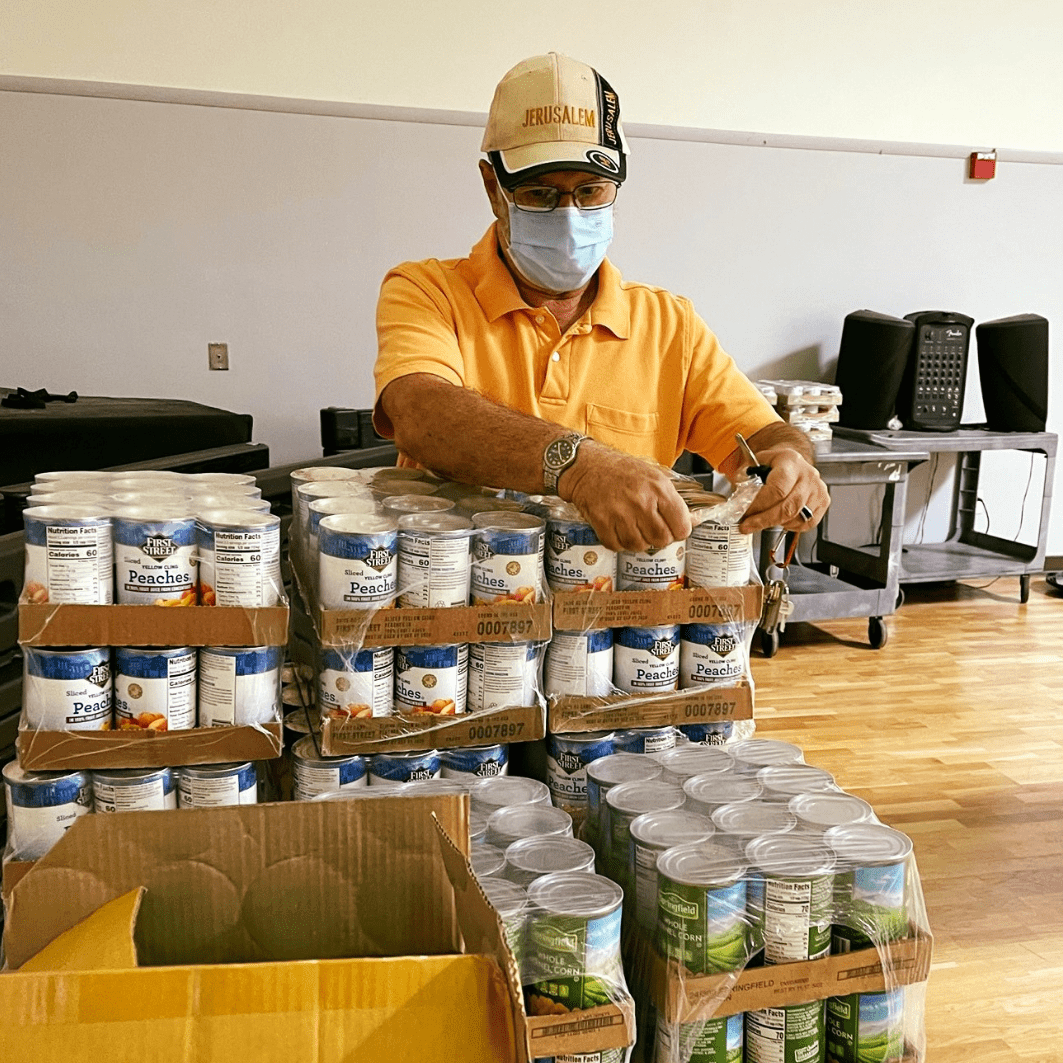

Provides meals

Through our JBox program, including the JBox Food Pantry, the EVJCC provides meals and food to poor or homebound seniors and children and families in need.

Helps the homeless

Programs help provide food, clothing and toiletries to homeless individuals and families in need.

Preschool and camp scholarships

Scholarships help families with financial challenges who want to send their children to preschool or camp.

Provides financial assistance

The EVJCC distributes money for qualified services through other Jewish agencies in Arizona that provide those services.

Use your AZ Tax Credit to make a difference in your community!

Give up to $800. Get it back in tax credits. Donate NowWhat is the difference between a Tax Credit and Tax Deduction?

A tax credit reduces the amount you owe in AZ State income taxes. So, for instance, if you owe $5,000 in state income taxes, and you give $800 to the EVJCC as a tax credit, you would only owe $4,200.

A tax deduction comes off your total income. So if your total income was $60,000 for the year and you donated $800 then it would reduce your income to $59,200 and that is what your tax would be based on. So your tax bill would not be reduced that much.

What is the EVJCC QCO?

The EVJCC has established a separate organization (EVJCC QCO) recognized by the State of AZ as a Qualifying Charitable Organization. For more information please visit: AZ Dept. of Revenue – Info on Qualifying Charitable Organizations. Donors should use the the EVJCC QCO code 20885 when taking the tax credit on their income tax returns. To make sure you are eligible for the tax credit please check with your tax adviser.